🔨👨🔧 Safeguard your livelihood with comprehensive Tradie Tool Insurance. Essential cover for tradespeople. Protect your tools now! 💼

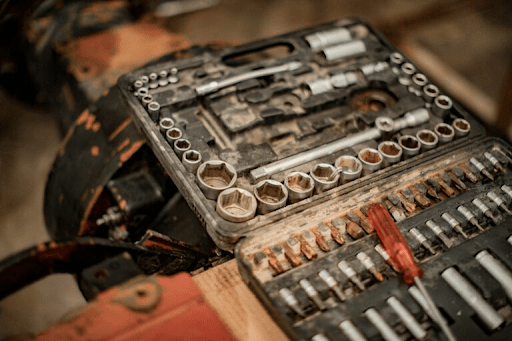

In the world of tradespeople, tools are not just instruments; they are the lifeblood of a business. Whether you’re an electrician, plumber, carpenter, or any other skilled tradesperson, your tools represent a significant investment in your career. From drills and saws to specialized equipment, the cost of replacing these items can be daunting. This is where comprehensive tradie tool insurance comes into play, providing essential cover that safeguards your tools and your livelihood.

Understanding Tradie Tool Insurance

Tradie tool insurance is designed specifically for professionals who rely on their tools to perform their jobs. This type of insurance covers the theft, loss, or damage of tools, ensuring that tradespeople can quickly replace what they need to continue working without significant financial strain. Unlike general property insurance, tradie tool insurance is tailored to the unique needs of tradespeople, addressing the risks and challenges they face daily.

Why You Need Tradie Tool Insurance

Protection Against Theft: The unfortunate reality is that theft of tools is all too common in the trade industry. Whether tools are stolen from a work site, a vehicle, or a storage unit, the loss can be devastating. With comprehensive tradie tool insurance, you can recover the costs associated with replacing stolen tools, allowing you to get back to work quickly.

Coverage for Damage: Tools can suffer damage due to accidents, mishandling, or extreme weather conditions. For instance, a water-damaged electrical tool can lead to significant repair costs or a complete loss if the damage is irreparable. Tradie tool insurance provides coverage for such incidents, ensuring that you are not left bearing the financial burden of repairs or replacements.

Business Continuity: For many tradespeople, their tools are essential for their livelihood. Without them, work can come to a halt, resulting in lost income. By investing in tradie tool insurance, you can minimize downtime. The quick replacement of tools means that you can resume work without substantial delays, keeping your business running smoothly.

Peace of Mind: Knowing that your tools are protected can alleviate stress and allow you to focus on what you do best in your trade. With the assurance that you have a safety net in place, you can take on projects with confidence, knowing that you won’t face financial ruin due to unexpected tool loss or damage.

Key Features of Comprehensive Coverage

When selecting tradie tool insurance, it’s important to understand the key features and benefits that comprehensive coverage offers. Look for policies that include:

All-Risk Coverage: This covers all forms of loss or damage unless explicitly excluded. It provides the broadest protection, ensuring that you’re covered for almost any unforeseen incident.

Replacement Cost Coverage: This feature ensures that you are reimbursed for the current replacement cost of your tools rather than their depreciated value. This is crucial for maintaining your business without incurring additional out-of-pocket expenses.

Worldwide Coverage: If you travel for work, worldwide coverage ensures that your tools are protected no matter where your job takes you. This is especially important for tradespeople who may work on projects outside their local area.

Flexible Premiums: Many insurance providers offer customizable premium options that can fit various budgets and coverage needs. This flexibility allows you to choose a plan that suits your specific circumstances.

How to Choose the Right Policy

Choosing the right tradie tool insurance policy involves several considerations. Start by assessing the total value of your tools and the specific risks you face as a tradesperson. Research various insurance providers and compare their policies, coverage limits, and exclusions. It’s also wise to read customer reviews and testimonials to gauge the reliability and responsiveness of the insurer in times of claims.

Consider consulting with an insurance broker who specializes in trade insurance. They can provide expert advice tailored to your needs and help you navigate the complexities of different policies, ensuring you find the best coverage for your situation.

Conclusion

Investing in comprehensive tradie tool insurance is a proactive step that tradespeople can take to protect their valuable tools and ensure business continuity. With coverage against theft, damage, and loss, tradespeople can work with peace of mind, knowing that they are financially safeguarded against unexpected events. In a field where tools are not just equipment but essential assets, having the right insurance can make all the difference between thriving and merely surviving in a competitive market. Protect your tools and your livelihood consider comprehensive tradie tool insurance today.